ArcelorMittal (MT)·Q4 2025 Earnings Summary

ArcelorMittal Beats on Revenue as Europe Trade Reset Reshapes Outlook

February 5, 2026 · by Fintool AI Agent

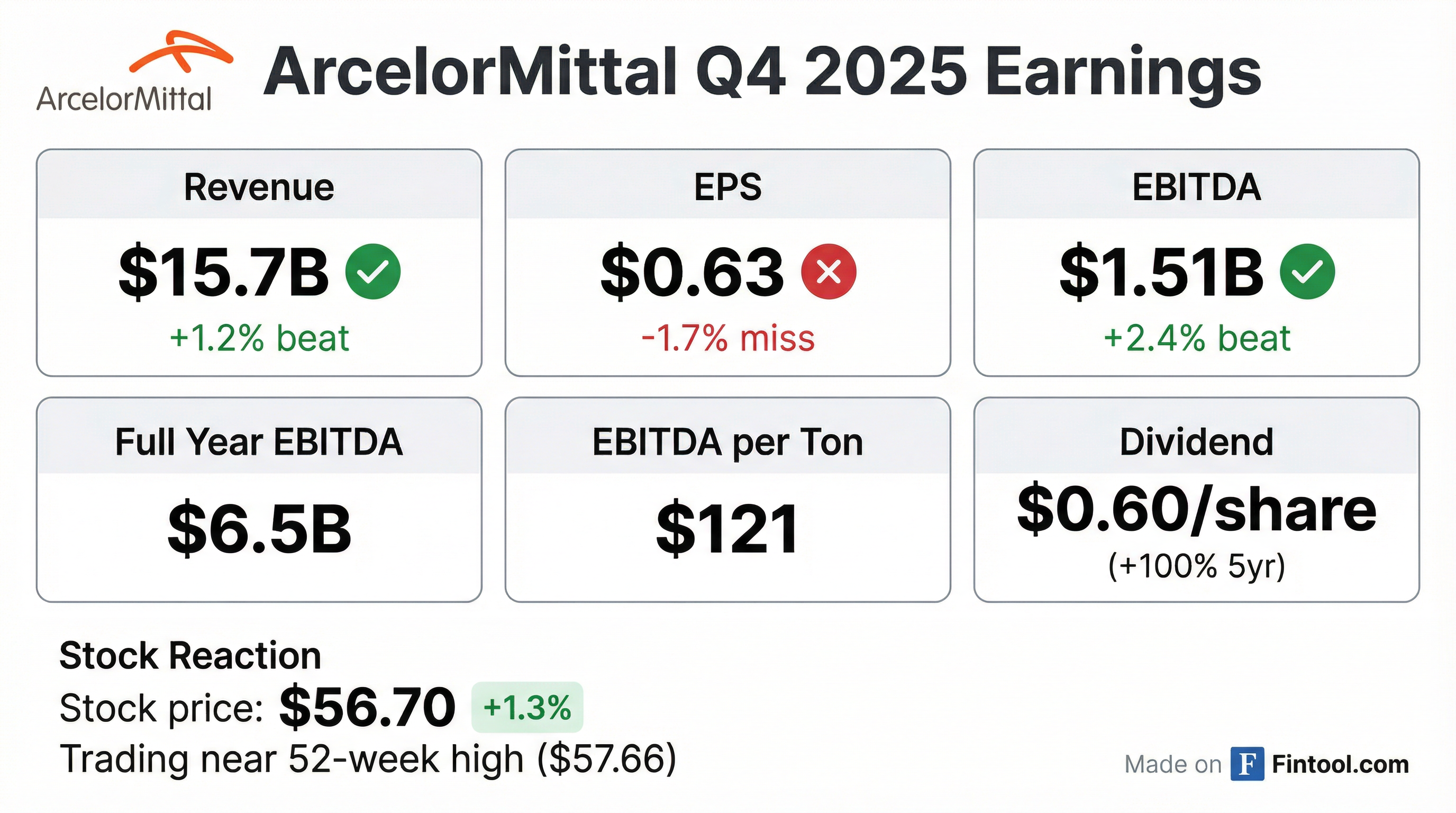

ArcelorMittal delivered a mixed Q4 2025, beating revenue and EBITDA estimates while narrowly missing EPS consensus. But the bigger story is Europe: CEO Aditya Mittal declared the region "fundamentally reset" after new carbon border adjustments (CBAM) and tariff rate quotas (TRQ) took effect, creating what he called "conditions for a balanced market structure that will restore profitability and returns on capital to healthy levels."

The stock is trading near its 52-week high at $56.70, up 1.3% on the day and up 144% from its 52-week low of $23.20.

Did ArcelorMittal Beat Earnings?

Full year 2025 EBITDA came in at $6.5B, equivalent to $121 EBITDA per ton shipped — nearly double the margin at previous cyclical lows, per CFO Genuino Christino.

8-Quarter Beat/Miss History

Values retrieved from S&P Global

What Changed This Quarter? The Europe Trade Reset

The most significant development in Q4 was not in the financials but in trade policy. ArcelorMittal has been vocal about the need to address market distortions from excess capacity and unfair trade dynamics — and 2025 delivered.

Two key policy changes:

-

CBAM (Carbon Border Adjustment Mechanism) — Effective January 1, 2026, imported steel now pays the same carbon cost as domestic production. "We are now competing on a more level playing field," said Mittal.

-

TRQ (Tariff Rate Quota) — Expected by July 1, 2026, this will "significantly limit the amount of steel that can be dumped into the European market." Management estimates ~10 million tons of imports will be displaced, with ~8 million tons in flat products.

ArcelorMittal's position: The company has idle capacity it can restart quickly without significant CapEx:

- Sestao mini mill ramp-up underway

- New electric furnace in Gijón

- Spare blast furnace capacity in France and Poland

"We don't have that much long lead time in bringing on some of this capacity," said Mittal. The company maintains ~30% market share of domestic European supply and expects to meet demand as imports are displaced.

What Did Management Guide?

Management was bullish on 2026:

"We expect higher steel production and shipments across all our regions this year, supported by operational improvements and strengthened trade protections. We are confident in our ability to continue generating positive free cash flows in 2026 and beyond."

Specific Q1 2026 guidance:

- North America: Higher volumes (Mexico operational issues resolved) + higher prices

- Europe: Higher shipments (seasonal) + prices improving (more Q2 phenomenon) + higher costs (raw materials, CO2)

- Brazil: Relatively stable

- Mining (Liberia): Continued ramp-up, stable shipments QoQ

CapEx guidance: $4.5B-$5.0B annually, unchanged. This includes all capacity restarts and growth projects without requiring additional investment.

D&A guidance for 2026: $2.9B-$3.0B

How Did the Stock React?

The stock closed at $56.70, up 1.3% on earnings day. Key context:

- 52-week high: $57.66 (nearly there)

- 52-week low: $23.20

- 50-day MA: $47.40 (20% premium)

- 200-day MA: $37.27 (52% premium)

The market is pricing in the Europe trade reset thesis. ArcelorMittal is up 144% from its 52-week low as investors anticipate improved European profitability and reduced import competition.

Capital Allocation: Dividend Doubled, Buybacks Continue

ArcelorMittal proposed a $0.60/share base dividend — double the level from five years ago.

5-year capital return track record:

- Share count reduced by 38% via buybacks — "a pace unmatched by any of our peers"

- Total investable cash flow since 2021: $23.5B

- 2025 investable cash flow: $1.9B

Capital allocation policy: 50% to shareholders, 50% to growth. "The policy has been working extremely well... the buyback will continue to be our preferred tool to return cash to shareholders."

Strategic Growth Projects: $1.6B EBITDA Runway

Strategic projects contributed $0.7B of new EBITDA in 2025, driven by:

- Record performance in Liberia mining operations

- Continued build-out of renewables capacity in India

- Full consolidation of Calvert (US) operations

Forward EBITDA uplift: An additional $1.6B of EBITDA from strategic projects "in the near future"

Key Growth Initiatives

Key Q&A Highlights

On Restarting European Capacity

Q: How quickly can you bring idle capacity online?

Mittal: "We could meet the deadline that is projected... We don't have that much long lead time in bringing on some of this capacity. Also recognize that we have a lot of slack capacity in Brazil. So we can augment our facilities with slabs from Brazil."

On Decarbonization Economics

Q: What are next steps for decarbonization projects?

Mittal: "We call it economic decarbonization because it has to make economic sense... The conditions have been pre-met. There is an economic case to decarbonize our operations." The company will pursue projects sequentially to avoid overburdening the organization.

On Demand Outlook

Q: Can you give European demand forecast?

Mittal: "Bare steel consumption is changing... the change in our shipments is much more driven by trade policy." Medium-term positives include German infrastructure spending and European defense spending moving toward 5% of NATO commitment.

On Substitution Risk

Q: Is there risk of demand destruction from higher prices?

Mittal: "We have gone through markets in which there have been significant tariff or trade measures put in place... we have not seen that level of demand destruction or significant demand destruction in the downstream industries."

Risks and Concerns

-

Trade measure implementation timing: TRQ expected July 1, 2026, but "time will tell" on Russian slabs exclusion and downstream industry measures

-

Cost inflation: Raw material basket and CO2 costs moving up, impacting Q1 margins

-

Net debt increase: Net debt rose to $7.9B in Q4 2025 from $5.2B a year ago, partly due to Calvert consolidation and growth investments

-

Ilva litigation: Company disclosed potential legal exposure but has no provisions; expects resolution "may last for a couple of years"

-

Trade diversion to other markets: Higher risk of dumping in Canada, Mexico, Brazil, India as US/EU tighten restrictions. Management expects governments to react.

Forward Catalysts

Key Takeaways

-

Europe is the story. CBAM + TRQ create structural support for European steel margins. ArcelorMittal has idle capacity ready to capture displaced import volumes.

-

Mixed Q4 numbers, strong outlook. Revenue and EBITDA beat while EPS slightly missed. Management guided higher volumes and prices across regions for 2026.

-

Capital returns accelerating. Dividend doubled to $0.60, shares down 38% over 5 years. Buybacks remain preferred tool.

-

Growth projects delivering. $0.7B EBITDA contribution in 2025, $1.6B more expected. India expansion, Liberia mining, Calvert all progressing.

-

Near 52-week high for a reason. The stock has more than doubled from its lows as the market prices in the Europe trade reset.

This analysis covers ArcelorMittal's Q4 2025 earnings call held on February 5, 2026.

Read more: ArcelorMittal Company Profile | Full Q4 2025 Transcript